Irs Fsa Amount 2025

BlogThe irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts. Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to.

Amounts contributed are not subject to federal income tax, social security tax or medicare tax. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

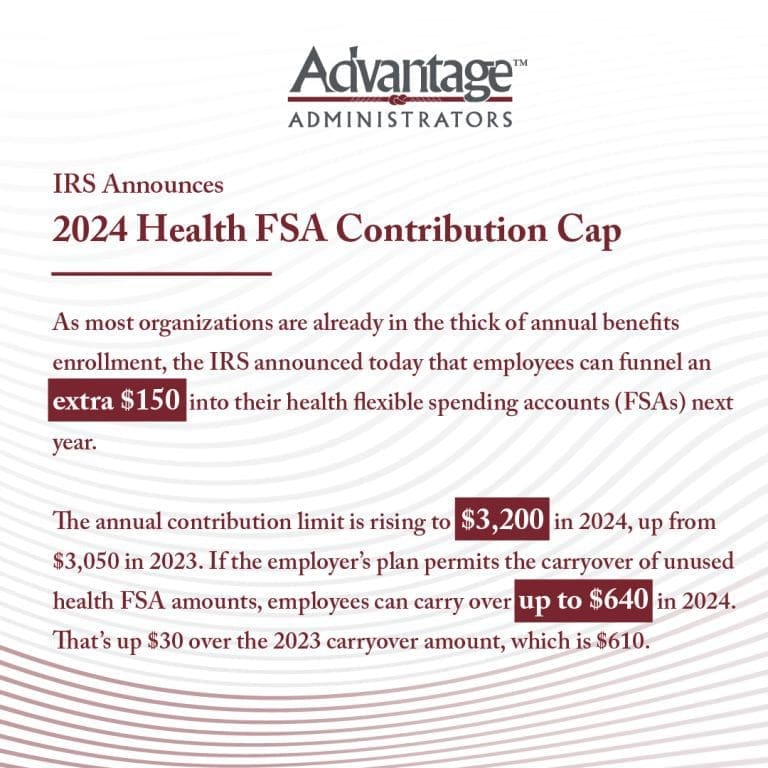

Irs List Of Fsa Eligible Expenses 2025 Rorie Claresta, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). You must use your fsa contributions before an annual deadline or risk forfeiting your money.

IRS Raises 2025 Employee FSA Contribution Limit to 3,200 NTD, For 2025, the irs sets limits for health flexible spending accounts (fsas). Your employer can also contribute to your fsa.

Irs Fsa Rules For 2025 Image to u, For 2025, the irs sets limits for health flexible spending accounts (fsas). On november 10, via rev.

IRS increases FSA contribution limits in 2025; See how much, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. But there is a caveat:

The IRS Just Announced the 2025 Health FSA Contribution Cap!, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts. For 2025, the irs sets limits for health flexible spending accounts (fsas).

New 2025 FSA and HSA limits What HR needs to know HRMorning, Here, a primer on how fsas work. The maximum salary reduction limit is $3,050, and there’s a carryover limit of $610.

IRS Releases 2025 FSA Contribution Limits Alegeus, Employees can now contribute $150 more. For 2025, the fsa annual salary.

IRS Roundup 2025 Tax Brackets, 401(k) Contributions, and FSA Limits, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to.

401K Limits 2025 Stefa Emmalynn, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose.

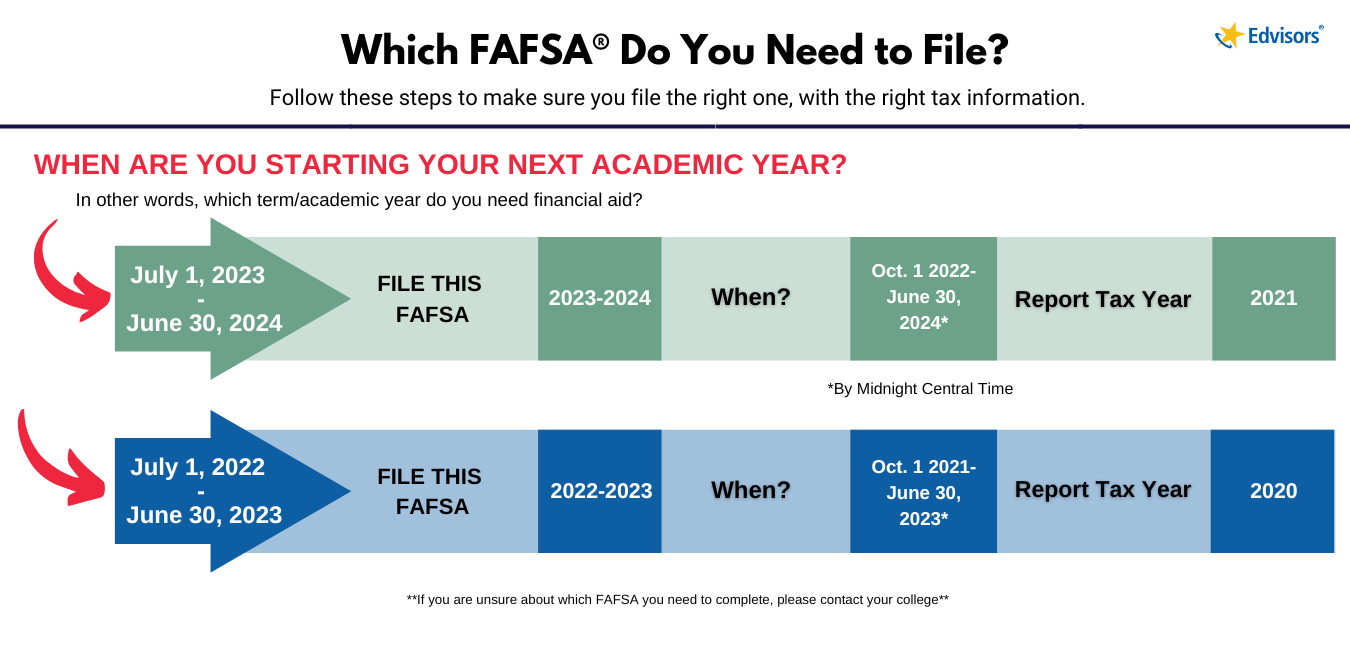

Fafsa Deadline 2025 To 2025 Tax Joete Madelin, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). Employees can now contribute $150 more.

The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2025 (up from $3,050 in 2025).

Travel Hiking WordPress Theme By WP Elemento